Why Mexico is the Smart Choice for Global Medical Device Expansion

Published 08/30/2025

Table of contents

- Why Mexico is the Smart Choice for Global Medical Device Expansion

- Overview of Mexico’s Medical Device Industry

- Key Advantages of Choosing Mexico for Medical Device Production

- Regional Clusters for Medical Device Production in Mexico

- Regulatory Framework for Medical Devices in Mexico (COFEPRIS)

- Thuasne: Strengthening Its Global Presence Through Mexico

- How Shelter Services Support Medical Device Companies in Mexico

- Future Opportunities in Mexico’s Medical Device Sector

- Partner with American Industries to Scale Your Medical Device Operations

In a constantly evolving manufacturing landscape, Mexico has positioned itself as the leading supplier of medical devices to the United States, surpassing traditional competitors such as China. This rise is driven by a strategic combination of competitive costs, a highly skilled workforce, and the logistical advantages of nearshoring.

Below, we will analyze why more global companies are choosing Mexico to expand their operations and how the country is consolidating itself as a key player in the global healthcare supply chain.

Overview of Mexico’s Medical Device Industry

Mexico’s medical device industry has emerged as a crucial global hub for production and innovation. The numbers speak for themselves:

The country currently has around 2,500 specialized companies, more than 600 of which actively participate in exports. The industry generates approximately 140,000 direct jobs, highlighting its importance to the Mexican economy.

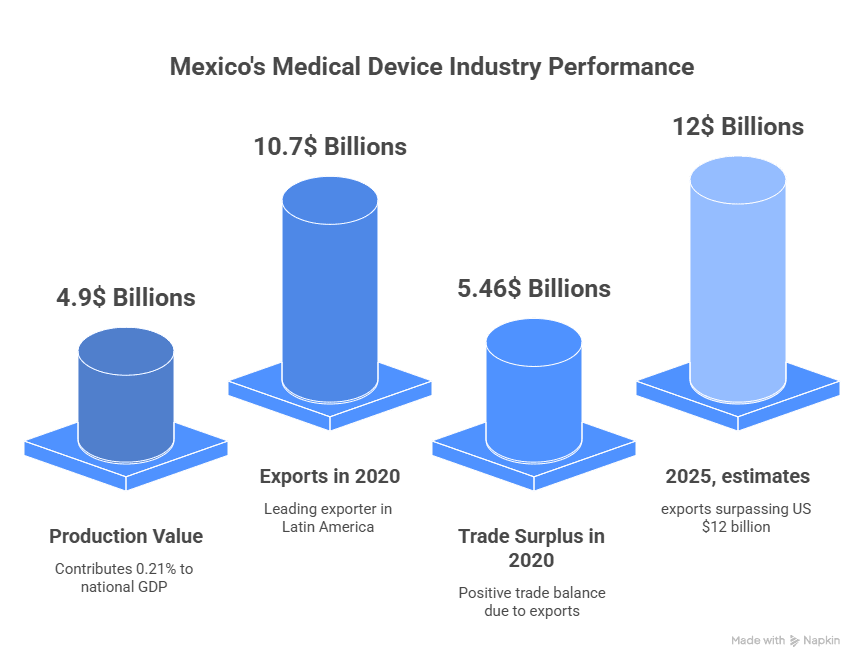

Production value reaches US $4.9 billion, representing about 0.21% of the national GDP and 1.57% of total manufacturing. With these figures, Mexico ranks as the eighth-largest medical device manufacturer in the world and the leading exporter in Latin America, a leadership reinforced by the nearshoring trend and proximity to the U.S. market.

Exports have grown steadily. In 2020, they reached US $10.7 billion, with a trade surplus estimated at US $5.46 billion. Of that total, 96.7% was destined for the U.S., equivalent to US $9.6 billion. The sector’s dynamism is reflected in an average annual export growth of 8.6%, compared to 7.9% for imports, resulting in a positive trade balance for Mexico.

In recent years, this trend has only accelerated. By 2023, estimates indicated over 700 specialized companies, a workforce of 160,000 highly qualified jobs, and exports surpassing US $12 billion, driving an annual growth rate close to 10.7%.

Baja California, particularly Tijuana, has become the country’s most important cluster, concentrating over 50% of national exports. More than 80 companies operate there, generating around 74,000 direct jobs. Even under more conservative estimates, at least 76 companies are counted, responsible for half of national production with over 71,000 jobs.

However, the industry is not limited to the northern border. Emerging regions such as Guanajuato have begun to consolidate new development hubs, driven by the Life Innovation & Technologies Cluster and supported by a young workforce — with a national median age of just 29.3 years — ensuring sustainability and dynamism for the sector in the near future.

Key Advantages of Choosing Mexico for Medical Device Production

Mexico offers an unmatched strategic advantage for global medical device manufacturers, especially compared to Asia:

- Competitive, specialized labor in advanced manufacturing processes.

- Geographic proximity to the U.S., reducing logistics times and transportation costs.

- Strong intellectual property protection and preferential access through the USMCA.

- Trade stability and lower tariffs, compared to Asia.

These advantages make Mexico a more attractive option than China, particularly for companies seeking speed, cost efficiency, and resilient supply chains.

Regional Clusters for Medical Device Production in Mexico

Mexico’s medical device industry has developed regional clusters that encourage specialization and collaboration:

- Baja California (Tijuana): The country’s main medical device export hub, home to companies focused on assembly, injection molding, and the production of medical consumables. Its proximity to California makes it a strategic point for trade with the U.S., offering reduced delivery times and logistics costs.

- Jalisco (Guadalajara): Specializes in medical electronics and technology, ideal for innovation projects. The region develops diagnostic equipment and wearable devices, fueled by its closeness to Silicon Valley, which has encouraged the creation of startups, R&D centers, and innovation labs in high-tech medical devices.

- Mexico City and the Bajío: Known for a diversified medical supply chain that includes component providers, sterilization services, and logistics solutions. The Bajío region — including Querétaro, Guanajuato, and San Luis Potosí — is emerging as a new manufacturing hub thanks to its central location and availability of skilled labor, making it a key area for expansion projects.

Regulatory Framework for Medical Devices in Mexico (COFEPRIS)

The regulatory framework is overseen by the Federal Commission for the Protection against Sanitary Risks (COFEPRIS), the authority responsible for ensuring the safety and quality of medical devices.

Medical devices are classified into three categories according to their level of risk:

- Class I: Low risk (e.g., bandages, gloves).

- Class II: Medium risk (e.g., diagnostic equipment, syringes).

- Class III: High risk (e.g., implants, pacemakers).

Foreign companies must designate a Mexico Registration Holder (MRH) to manage the registration and approval process. Here, shelter services play a key role by helping companies comply with regulatory requirements and reducing risks when entering the market.

Thuasne: Strengthening Its Global Presence Through Mexico

Thuasne, a leading medical equipment manufacturer specializing in medical textiles, compression garments, and orthotics, stands out as a key player. With a strong legacy in the medical field, Thuasne has successfully expanded its operations to Mexico, leveraging the country’s strategic advantages to strengthen its position among the top medical device companies.

With the assistance of American Industries, Thuasne successfully established its manufacturing facility in Mexico, marking a significant milestone in its global expansion. The facility was designed to optimize production processes and increase output to meet the growing demand for Thuasne’s compression garments and orthopedic products.

How Shelter Services Support Medical Device Companies in Mexico

Shelter services provide comprehensive support that facilitates market entry and business growth in Mexico:

- Specialized talent recruitment: Medical device production requires engineers, technicians, and operators trained in high-precision processes. Shelter providers handle the attraction, evaluation, and hiring of talent that meets industry standards, ensuring faster integration and alignment with project needs.

- Strategic site selection: Choosing the right location is essential for operational efficiency. Shelters assist in analyzing regional clusters, supplier availability, proximity to the U.S., and logistics connectivity to identify optimal sites with competitive advantages.

- Certifications such as IMMEX and OEA: These programs are key to accessing tax benefits, streamlining import/export processes, and ensuring supply chain security. Shelters help companies obtain and maintain these certifications, reducing administrative burdens.

- Regulatory compliance with COFEPRIS: Navigating the registration and classification process for medical devices in Mexico can be complex. Shelters act as guides, ensuring every step — from appointing an MRH to product approval — complies with COFEPRIS regulations and avoids costly delays.

- Reduction of operational and administrative risks: From payroll and tax compliance to preventing legal and labor contingencies, shelters absorb critical responsibilities that could otherwise threaten operations. This allows foreign companies to operate with greater security, flexibility, and confidence.

Thuasne chose to collaborate with American Industries due to the company’s strong reputation and extensive history as a leading shelter provider in Mexico. Transparency, organizational capabilities, industry expertise, responsiveness, and well-established regional connections were key factors in its decision-making process.

Future Opportunities in Mexico’s Medical Device Sector

The future of the industry in Mexico points to sustained growth driven by nearshoring and the adoption of new technologies. Companies in Mexico are already innovating in areas such as:

- Advanced diagnostic devices.

- Health wearables.

- AI-driven medical technologies.

- Smart medical textiles.

- 3D printing for customized devices.

Projections indicate significant growth in exports to the U.S., further strengthening Mexico’s position as a strategic partner in the sector.

Partner with American Industries to Scale Your Medical Device Operations

Mexico represents a unique opportunity for medical device companies seeking to expand efficiently and securely. With the support of American Industries, your company can maximize the country’s competitive advantages, reduce risks, and accelerate success in the global market.

Contact us today and discover how we can help you scale your medical device operations in Mexico.

Latest Posts

If you would like to find out more about this topic or are interested in receiving a complimentary business case analysis for your operation in Mexico, please fill out this form or contact us at:

US toll-free: +1 (877) 698 3905

CN Toll-free: +1 (400) 076 8899

Attention hours from M to F 9:00 - 18:00 CST

Please note that we do not accept job applications here. If you are interested in applying for a position, please visit the following link: https://www.americanindustriesgroup.com/jobs/