Mexico's FDI Boom: Unveiling the Future of Nearshoring and International Manufacturing

By Víctor Hugo Rodríguez | Business Development and Marketing Manager at American Industries Group®

Published 02/20/2025

Mexico is a geographically privileged country: being located in the heart of America, it is a country with connectivity with the United States and Canada as well as with all the countries of Central and South America.

In addition, its economic growth, highly skilled labor force and infrastructure have earned the trust of investors from countries around the world, mainly from the United States, who are looking for nearshoring in Mexico.

Today in the American Industries blog we will analyze what is nearshoring in Mexico, its objectives, the reasons why companies seek to relocate their operations and how we can help you relocate your business through our specialized services.

What is Nearshoring?

Nearshoring is a business strategy that consists of relocating part or all an organization's production to another country that is geographically close. This practice allows companies to get closer to their final consumer, reduce costs and reduce logistical risks.

In general, companies looking to relocate their operations opt for nearby countries with a similar time zone and culture to create a more efficient and resilient supply chain.

Reasons driving nearshoring in Mexico

Mexico's nearshoring drive has been driven by a combination of factors that have made the country the right place for international companies:

- Proximity to the United States, Central and South America, which reduces transportation costs and facilitates logistics.

- High tariffs imposed by the United States on Chinese products.

- Trade agreements such as the T-MEC (Treaty between Mexico, the United States and Canada) that reduce tariff barriers to facilitate international trade.

- The coronavirus pandemic caused border closures around the world, prompting companies around the world to seek new agreements to reduce delivery times and streamline operations.

- Mexico has a network of airports, highways and ports that connects to every city in the country, facilitating the transportation of goods both within the country and to other countries.

Foreign Direct Investment in Mexico: An Overview

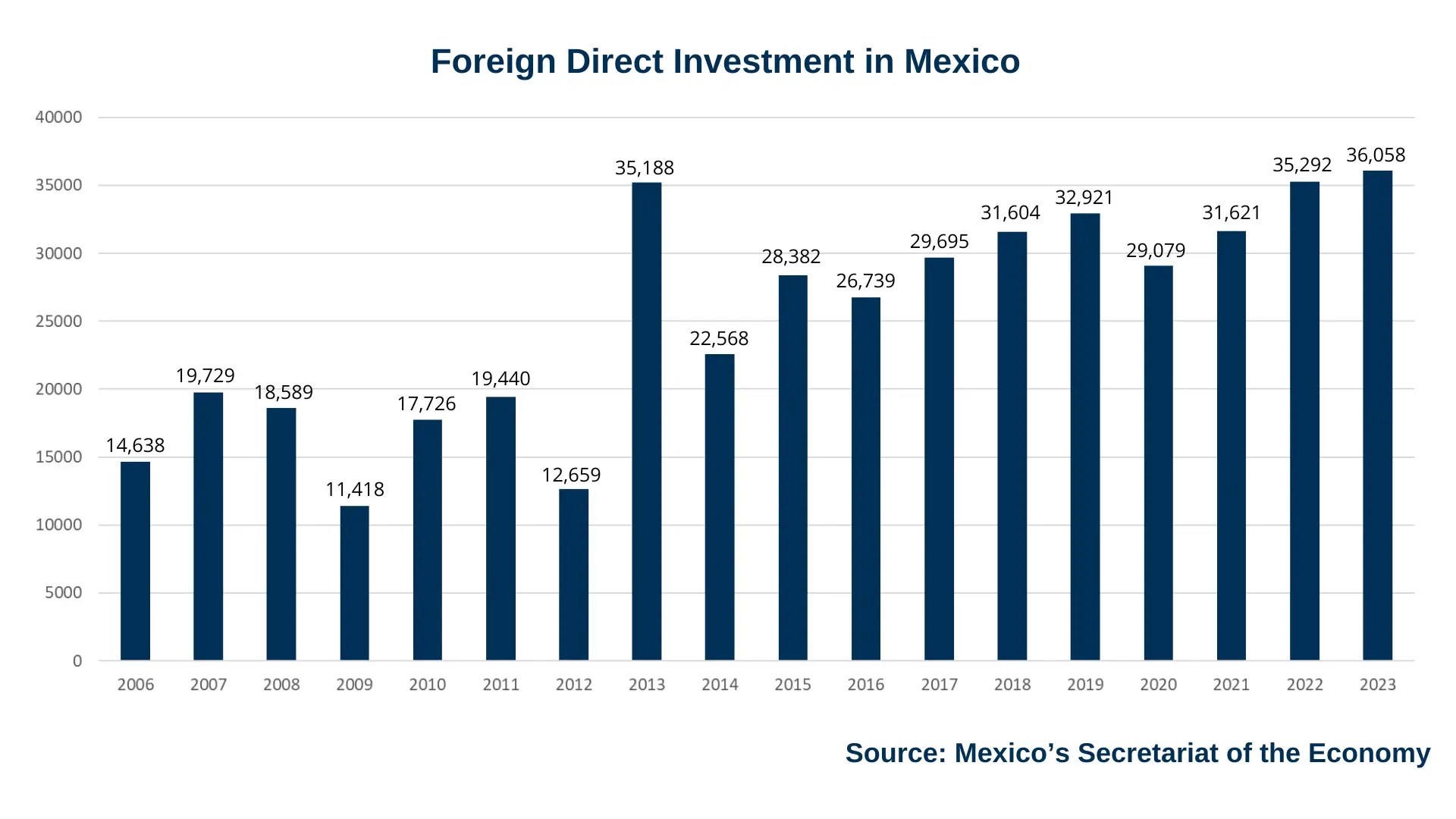

In 2023, Mexico's foreign direct investment soared to new heights, revealing the country's allure to global investors. This 2.2% increase from the previous year reveals a deep-seated trust in Mexico's economic direction and a growing interest across various sectors.

The factors driving FDI in Mexico include its ideal position as a bridge between markets, a broad network of free trade agreements, and a stable economic environment. These elements, combined with Mexico's emphasis on economic reforms and infrastructure development, paint a promising picture for the nation's investment landscape.

The Rise of the Manufacturing Industry

The manufacturing industry is a pillar of the Mexican economy and has been key to boosting foreign trade. Mexico is one of the countries with the highest exports of manufactured products, making it a strategic location for relocation.

Nearshore Services and Mexico's Strategic Advantage

Mexico stands out as a leading choice for nearshore services, offering foreign manufacturers unmatched proximity, efficiency, and cost-effectiveness. Nearshoring in Mexico allows companies to reduce transportation costs and time, improve supply chain reliability, and access a skilled labor pool. The country's free trade agreements and robust infrastructure make it more attractive as a nearshore destination, providing a stable and efficient base for doing business close to the U.S. market.

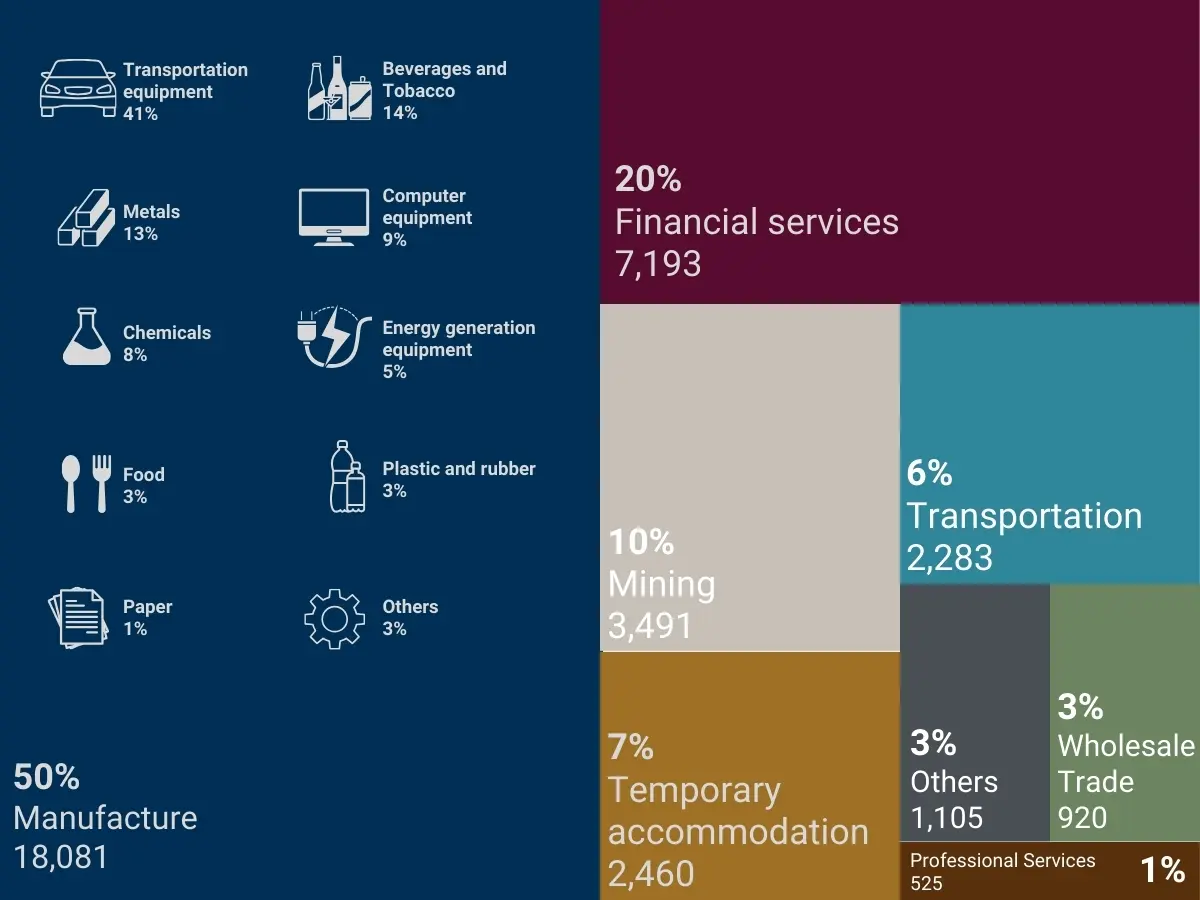

Sectoral and Geographic Distribution of FDI in Mexico

FDI in Mexico spans multiple sectors and regions, highlighting the variety and breadth of investment possibilities. The automotive and aerospace industries, in particular, highlight Mexico's strength in supporting high-value manufacturing, benefiting from its skilled workforce and competitive costs. Additionally, high-tech and renewable energy are emerging sectors driven by Mexico's focus on innovation.

FDI is distributed across the country, with states like Nuevo León, Jalisco, and the Bajío region emerging as crucial investment destinations due to their manufacturing prowess and logistical advantages. This distribution promotes balanced growth and the development of specialized industrial clusters throughout the country, further boosting Mexico's proposition for nearshoring. The surge in FDI signifies not just Mexico's current economic health but also its potential for future growth.

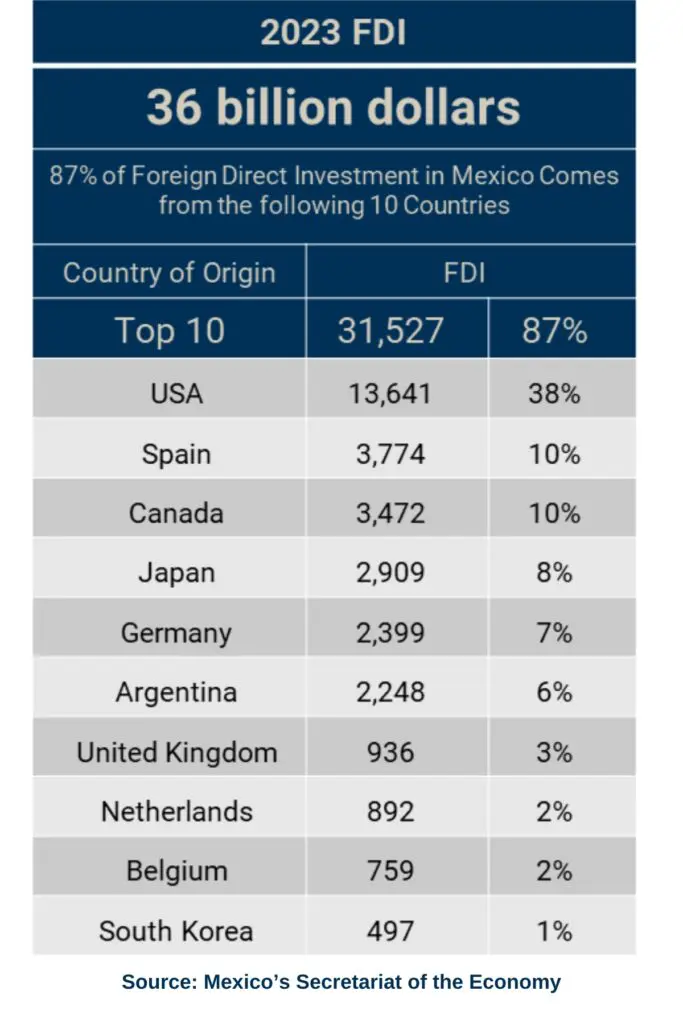

In 2023, the United States remained the predominant source of Foreign Direct Investment (FDI) in Mexico, reflecting longstanding economic ties and shared market interests. However, a notable diversification in the origin of investments was observed, with contributions from countries such as Canada, Spain, and Japan, demonstrating Mexico's global appeal and growing importance in the international investment landscape.

Economic benefits for Mexico and the United States

Nearshoring in Mexico is an increasingly attractive business model for transnational companies thanks to benefits such as:

- Access to new markets

- Diversification of risks associated with unforeseen events such as geopolitical conflicts, border closures or health crises.

- Reduced costs in labor, taxes and transportation.

- Streamlined supply chains through shorter delivery times

- Reduced dependence on services in Asian countries

- Strengthened trade relations with Mexico

For Mexico, nearshoring represents a great opportunity thanks to benefits such as: - Generation of new jobs in industries such as manufacturing or technology.

- Increase in the development of national industry

- Economic growth thanks to the increase in Foreign Direct Investment (FDI).

- Diversification of the Mexican economy

The promotion of nearshoring in Mexico has allowed benefits for both countries, such as economic integration, in terms of rules and regulations to create fair working conditions, which attract more companies to invest and continue to grow the economy.

Navigating Challenges and Seizing Opportunities for Nearshoring in Mexico

While the opportunities for nearshoring in Mexico are vast, foreign investors will face the learning curve of adapting to a new local regulatory environment and cultural differences. Shelter services are crucial in streamlining the process, offering expertise in legal compliance, hiring practices, and integration into the Mexican market.

The future growth of FDI and nearshore services in Mexico looks bright, supported by the country's advantageous location, strong manufacturing sector, and dedication to economic reforms. For foreign manufacturers exploring nearshoring in Mexico, key recommendations involve utilizing shelter services for easier setup and operations, conducting comprehensive market research, and collaborating with local partners to grasp the intricacies of the Mexican business environment.

By addressing potential challenges and leveraging Mexico's dynamic economy, foreign manufacturers can enjoy the benefits of nearshoring. Through shelter services, companies can mitigate risks, streamline operations, and secure their position in the competitive global market, contributing to the continued growth of foreign direct investment in Mexico.

For companies looking to explore the vast potential of nearshoring in Mexico, American Industries provides the guidance, support, and administrative services to ensure a seamless transition and successful operation. To learn more about how your business can benefit from nearshoring in Mexico, contact American Industries today and take the first step toward unlocking growth and competitive advantages in this evolving market.

FAQs: Foreign Direct Investment in Mexico

-

Why is Mexico an attractive destination for foreign direct investment?

Mexico's prime location, comprehensive trade agreements, and strong manufacturing sectors are attracting foreign direct investment. A skilled labor force and a stable economy make it an ideal location for businesses looking to grow in this market (2024).

-

Which sectors in Mexico are seeing considerable foreign direct investment inflows?

The automotive and aerospace industries are major beneficiaries of foreign direct investment in Mexico, thanks to the country's location, workforce, and trade policies. Emerging sectors like technology and renewable energy highlight Mexico's focus on sustainable and innovative development.

-

How do nearshore services enhance operational efficiency for foreign manufacturers in Mexico?

Nearshoring in Mexico cuts transportation costs, speeds up market access, and streamlines supply chains. Mexico's proximity to major markets and manufacturing capabilities make it ideal for efficiency gains.

-

What challenges might companies face when establishing nearshore operations in Mexico, and how can they be addressed?

Navigating regulatory landscapes and adapting to cultural differences can pose challenges. However, shelter services can mitigate these issues by providing legal compliance, cultural integration assistance, and access to skilled labor, ensuring a smooth operational transition.

-

Is now a good time to nearshore to Mexico? (2024)

A: Absolutely! Supply chain disruptions and the rise of regionalization make Mexico an ideal nearshoring partner in 2024. Mexico's focus on reforms, strong trade deals, and innovation creates a welcoming environment for foreign investment, putting your business closer to the North American market.

If you're interested in learning more about the benefits and key considerations for companies moving to Mexico, check out our in-depth blog on the topic.

If you would like to find out more about this topic or are interested in receiving a complimentary business case analysis for your operation in Mexico, please fill out this form or contact us at:

US toll-free: +1 (877) 698 3905

Attention hours from M to F 9:00 - 18:00 CST

Please note that we do not accept job applications here. If you are interested in applying for a position, please visit the following link: https://www.americanindustriesgroup.com/jobs/

YOU MIGHT ALSO LIKE