Mexico’s Aerospace Industry 2025: Growth and Innovation

Published 15/08/2025

Mexico’s aerospace industry has solidified its position as a dynamic and strategic sector, driven by a combination of high-quality manufacturing, a privileged geographical location, and an increasingly sophisticated supply chain.

In 2025, Mexico not only remains a key player in the global stage but has also positioned itself as an attractive destination for investment and innovation, especially within the framework of nearshoring.

Below, we will explore in detail how the sector is evolving, the challenges it faces, and the key opportunities that lie ahead for 2025.

Overview of Mexico’s Aerospace Industry

Mexico has established itself as one of the leading players in the global aerospace manufacturing sector. In 2025, it ranks as the 10th largest aerospace producer globally and 12th in aerospace component exports.

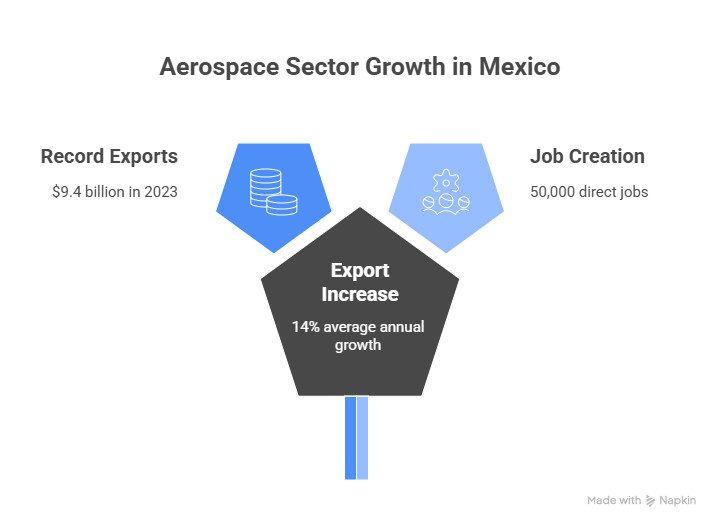

The Mexican aerospace sector has experienced sustained growth, with an average annual export increase of 14% since 2010.

In 2023, exports reached a record $9.4 billion, and it is estimated that by 2024, they surpassed $10.7 billion.

Currently, Mexico is home to more than 380 aerospace companies, spread across 19 states, with 370 manufacturing plants generating more than 50,000 direct jobs and approximately 190,000 indirect jobs.

Foreign Direct Investment (FDI) has been a key driver for the sector’s growth. Since 2006, Mexico has received over $3.7 billion in FDI in the aerospace industry, with an investment of $119.4 million in the first quarter of 2024 alone.

The United States is Mexico’s main trading partner in this sector, accounting for a significant portion of Mexican aerospace exports. Mexico has benefitted from the nearshoring trend, attracting global companies looking to optimize costs and delivery times by establishing operations in the country.

Mexico’s Aerospace Market

Mexico’s aerospace market has seen significant expansion in recent years, solidifying its role as a key player in the manufacturing and export of aerospace components. In 2024, the market reached a value of USD $11.73 billion, and it is projected to grow at a 17.2% compound annual growth rate (CAGR), reaching approximately USD $57.36 billion by 2034.

Mexican production has evolved beyond simple assembly, incorporating the manufacturing of complex parts, advanced electronics systems, and Maintenance, Repair, and Overhaul (MRO) services. In 2024, the MRO segment recorded the fastest growth, with an 8.35% CAGR.

Although the United States remains the main destination for Mexican exports, accounting for approximately 80%, Mexico has diversified its markets towards the European Union and Asia. By 2024, the European Union became the second-largest destination for Mexican aerospace exports and the second-largest foreign investor in the country.

This growth has been fueled by Foreign Direct Investment (FDI), which has surpassed USD $3.7 billion since 2006, with USD $119.4 million invested in just the first quarter of 2024. States such as Baja California, Chihuahua, Coahuila, Nuevo León, and Querétaro have been the main recipients of this investment, establishing strategic hubs with manufacturing plants, MRO facilities, and engineering centers.

The adaptability of Mexican companies, their ability to adopt advanced technologies, and a highly skilled workforce have been key factors in positioning the country as a comprehensive supplier in the global aerospace market.

Aerospace Trade Compliance under USMCA

To maximize the aerospace sector’s competitive advantages, it is crucial to understand the regulatory and fiscal framework. The United States-Mexico-Canada Agreement (USMCA) has simplified and unified the rules of origin, facilitating trade and investment. These include tax exemptions and simplified customs processes, such as the following:

IMMEX – Duty-Free Imports for Export-Oriented Operations

The IMMEX Program (Manufacturing, Maquiladora, and Export Services Industry) allows aerospace manufacturing companies to temporarily import inputs without paying tariffs or VAT, provided these products are used for export production.

This program has facilitated the expansion of operations in Mexico, significantly reducing production costs and making it easier for aerospace companies that manufacture or assemble products for export.

VAT Certification – 16% Tax Exemption on Temporary Imports

The VAT Certification is a fiscal benefit granted by the Mexican authorities. It offers a 16% VAT exemption on temporary imports of machinery and equipment used in the production of aircraft and components. This benefit is key in attracting foreign investment and fostering the sector’s growth.

Manufacturing Practices Certification – Streamlining Tariff Classification

The Manufacturing Practices Certification is an official document that simplifies the tariff classification for products such as medicines, food, or cosmetics. Issued by Mexican authorities, this certification ensures that a product is manufactured in Mexico, allowing the manufacturer to access tariff exemptions under international treaties such as the USMCA. This certification has reduced bureaucracy and sped up international trade, facilitating the export of aerospace products to major markets such as the United States and Canada.

Chapter 98 – Duty Exemptions for Aircraft Maintenance and Production

Chapter 98 of the USMCA offers duty exemptions for components and parts used in the maintenance, repair, and production of aircraft. This includes ground equipment, tools, and components, which reduces operational costs and enhances the sector's competitiveness. This provision has been vital for maintenance and production operations in Mexico, allowing companies to benefit from reduced costs.

Aerospace Clusters in Mexico

Mexico hosts several key aerospace hubs that drive innovation and sector growth. Each cluster specializes in different areas of the value chain, from manufacturing to advanced design and engineering.

Baja California (Tijuana, Mexicali)

Baja California is Mexico’s largest aerospace cluster, with over 100 companies operating in the state, accounting for approximately 21% of the country’s aerospace companies. It generates more than 40,000 direct jobs, including engineers, technicians, and operators, and has a strong supplier base of over 339 companies. Major activities in this cluster include the manufacturing of electronic components, precision assemblies, and propulsion systems.

Querétaro

Querétaro has become the aerospace epicenter of Mexico, excelling in design, engineering, and high-tech manufacturing. The state is home to more than 80 aerospace companies, including global giants such as Safran and Bombardier.

Additionally, it hosts the Aerospace University of Querétaro (UNAQ), the country’s first and only specialized aerospace institution, playing a crucial role in developing highly skilled talent.

Sonora and Chihuahua

Sonora is known as the "Mexican turbine capital", with 69 aerospace companies and over 20,000 jobs created. Its proximity to Arizona and New Mexico forms a binational mega-region for aerospace collaboration. Sonora’s companies specialize in engine components and air systems.

Chihuahua leads the country in aerospace engineering talent and innovation. The state is home to 25% of Mexico’s aerospace factories and produces metal components and composites for global OEMs such as Honeywell and Bell. Additionally, it has research and development centers that drive the adoption of advanced technologies.

Jalisco and Nuevo León

These states specialize in the production of aerospace electronics and technological support. Jalisco, known as Mexico’s "Silicon Valley," is home to more than 10 aerospace companies and stands out for its technological infrastructure and advanced manufacturing.

Nuevo León, in turn, established the Monterrey Technological Innovation and Research Park (PIIT), a research and development center that fosters collaboration between the academic and business sectors in areas such as mechatronics, advanced materials, and nanotechnology.

Aerospace Research Centers in Mexico

Mexico’s aerospace manufacturing sector is backed by a growing ecosystem of specialized research and innovation centers dedicated to advancing the industry’s technological capabilities. These institutions are crucial in strengthening Mexico’s competitiveness in high-value aerospace manufacturing through R&D, design, and advanced engineering.

Centro de Tecnologías Aeronáuticas de Querétaro (Querétaro Center for Aeronautical Technologies – CTA)

Located in one of the country’s leading aerospace hubs, CTA focuses on the development of aeronautical manufacturing technologies, materials science, and process optimization. It collaborates closely with private industry and academia to support innovation in components, structures, and assembly processes.

Centro de Desarrollo Industrial e Ingeniería de Querétaro (Querétaro Center for Industrial Development and Engineering)

This center specializes in applied industrial engineering and product development, working with the region’s aerospace manufacturers. Its contributions include the implementation of smart manufacturing systems and the development of testing protocols to improve production quality and efficiency.

Centro de Innovación y Diseño de Tijuana (Tijuana Innovation and Design Center – CONCAMIN)

Operated under the National Confederation of Industrial Chambers, this center in Baja California focuses on innovation, prototyping, and advanced product design. It supports startups and established aerospace firms with tools for digital design and rapid development, reinforcing the regional supply chain’s agility.

Centro de Investigaciones Aeroespaciales de Nuevo León (Nuevo León Center for Aerospace Research – UANL/CIIA)

Based at the Autonomous University of Nuevo León, this research center leads academic and applied research in aerodynamics, propulsion systems, and aerospace materials. It also contributes to the training of future engineers through specialized programs in aerospace sciences and manufacturing.

Instituto de Manufactura Aeroespacial y Avanzada de Sonora (Sonora Institute for Aerospace and Advanced Manufacturing)

Located in one of Mexico’s emerging aerospace corridors, this institute focuses on next-generation manufacturing methods and materials for aerospace applications. Its research includes additive manufacturing, lightweight composites, and automation technologies that support the production of complex aircraft components.

Together, these centers are essential to the evolution of Mexico’s aerospace industry, fostering innovation, strengthening supply chains, and preparing a skilled workforce ready to meet the demands of global aerospace manufacturing.

Benefits of Mexico’s Aerospace Industry

The growth of Mexico’s aerospace sector is driven by several factors that make it an attractive destination for investment:

- Cost efficiency: Operating, labor, and logistics costs in Mexico are significantly lower compared to the U.S. and other developed countries.

- Strategic location: Proximity to the United States, the largest market in the world, enables smooth logistical integration and reduces delivery times.

- Skilled workforce: Mexico has a growing number of engineers, technicians, and specialists in aerospace, trained at high-quality universities and institutions.

- Increased FDI: The nearshoring phenomenon has attracted a wave of foreign direct investment, strengthening the country’s infrastructure and production capacity.

- Resilient supply chains: The industry has developed a robust and diversified supply chain capable of handling the complexities of the global market.

Aerospace Supply Chain in Mexico

Another factor in the growth of the aerospace industry in Mexico is the global nearshoring trend. This shift toward more agile and resilient supply chains increasingly attracts aerospace companies to the country. Several key factors contributing to this include:

- Presence of Major OEMs: Leading Original Equipment Manufacturers (OEMs) such as Bombardier, Safran Group, and Zodiac Aerospace have established substantial operations in Mexico. The merged entities of Safran Group and Zodiac Aerospace notably operate nine facilities nationwide, demonstrating the country's integral role in aerospace manufacturing.

- Strategic Partnerships: Major OEMs like Bombardier, a renowned Canadian company, rely heavily on Mexican suppliers for crucial aerospace components.

- Complex Supply Chain System: The aerospace industry in Mexico features a sophisticated, multi-tiered supply chain. Tier 1 suppliers deliver integrated systems for final assemblies, while Tier 2 and 3 suppliers provide essential sub-systems and components.

Opportunities for the Aerospace Industry in Mexico

The future of Mexico’s aerospace industry looks promising, with emerging trends opening new doors. The adoption of composite materials, drone technology, aircraft electrification, and process digitalization through Industry 4.0 are factors positioning Mexico as a leader in sector innovation.

The nearshoring phenomenon will continue to play a crucial role, attracting more foreign direct investment and diversifying the country’s supplier base. This trend strengthens Mexico’s position as a strategic partner for global supply chains, offering advantages in proximity, competitive costs, and manufacturing quality.

While exports will continue to grow, dependence on the U.S. market will remain a key factor in the industry. However, the growth of new markets in Europe and Latin America opens the door for Mexico to continue consolidating its role as a key player in the global aerospace market.Leading airports such as Mexico City International Airport (AICM), Cancún International Airport, and Guadalajara International Airport continue to see high passenger volumes. In 2023, Cancún alone handled over 30 million passengers, highlighting the strength of Mexico’s tourism and travel sectors. Monterrey and Querétaro airports, meanwhile, are increasingly recognized as key hubs for business travel and cargo, particularly in support of the aerospace and manufacturing industries.

Additionally, new airport infrastructure projects—such as Felipe Ángeles International Airport (AIFA) and expansions in Santa Lucía and Tulum—are enhancing connectivity and easing congestion in Mexico’s central corridor. These developments support commercial aviation and the growing logistics demands of the aerospace sector.

This aviation growth aligns closely with the expansion of aerospace manufacturing in Mexico, as greater air connectivity enhances export capabilities, supports time-sensitive supply chains, and improves regional integration. As the sector continues to develop, Mexico’s aviation infrastructure will remain a crucial enabler of long-term industrial competitiveness and global reach.

Partner with American Industries to Scale Your Aerospace Operations

If your company is looking to enter the aerospace industry in Mexico, partnering with a local entity is crucial. American Industries is ready to support aerospace companies in their expansion in Mexico.

Our comprehensive shelter solutions and spaces in industrial parks help foreign companies establish themselves quickly and efficiently, mitigating operational risks and simplifying the regulatory compliance process.

If you are interested in learning more about Mexico’s thriving aerospace sector, you can connect with American Industries at the FIA in London or reach out today. Now is an opportune time to become part of this exciting growth trajectory, shaping the future of aerospace with cutting-edge technology and sustainable practices.

With more than 20 years of experience in creating industrial parks and providing logistical solutions, we offer the perfect environment to scale manufacturing operations in the country. Contact us to discover how we can help you maximize opportunities in the aerospace industry.

If you would like to find out more about this topic or are interested in receiving a complimentary business case analysis for your operation in Mexico, please fill out this form or contact us at:

US toll-free: +1 (877) 698 3905

Attention hours from M to F 9:00 - 18:00 CST

Please note that we do not accept job applications here. If you are interested in applying for a position, please visit the following link: https://www.americanindustriesgroup.com/jobs/

YOU MIGHT ALSO LIKE