Industrial Clusters in Jalisco: Key to Competitiveness

A variety of factors contribute to increasing a region’s competitiveness, including availability and cost of labor, supply chain maturity, industrial ecosystem, and logistics infrastructure. Yet, there is one factor that is commonly overlooked by many countries and regions which brings together several of these factors and has recently come to the forefront as playing a key role in facilitating economic dynamism and recovery: the formation and development of industrial clusters. In Jalisco, Mexico, government, industry, and academia have worked to establish and promote clusters in various sectors for decades. This work has created an environment with effective business interaction and supply chain management, and more public-private partnerships, allowing the state to reactivate more quickly than other regions after the global downturn in 2020.

First, it is essential to understand what a cluster is and how they contribute to increasing competitiveness and stimulating economic growth. A cluster is more than just a form of enterprise unification. It is the consolidation and organization of services, information, and material and financial resources of many entities, resulting in a synergy that is only achieved by establishing mutually beneficial long-term relationships and the trust this inspires. This synergy then opens up new opportunities for all businesses involved in a region’s supply chains. To put it simply: a cluster is the consolidation of a region’s main industrial forces and players.

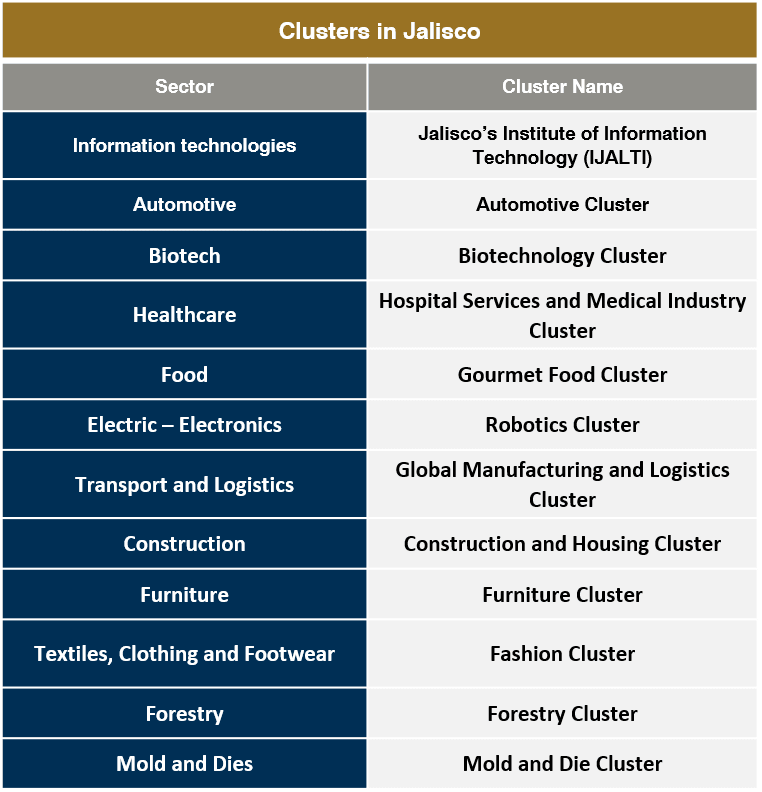

This unification is built upon the pillars of collaboration between companies, commitment to human talent, increasing regional or national content, creating a receptacle for ideas and brainstorming, increasing competitiveness in the industrial ecosystem, and spearheading innovation. Jalisco, one of the states in Mexico with the biggest number of clusters, has leveraged these factors to boost economic expansion and pave a path for national integration. Some of the main sectors with established clusters in Jalisco include:

One example of how Jalisco’s clusters support all companies in the supply chain and constantly evolve to provide added value to the entire region is its electronic manufacturing sector, which has become known as “Mexico’s Silicon Valley.” This robust cluster has been developing for over 30 years on the foundation of 12 original equipment manufacturers, including global players such as IBM, HP and Intel, and other domestic enterprises. These anchor companies focus on product development, research and development, marketing and distribution, and selling their products under their brand and intellectual property rights using components purchased from contract manufacturers. There are 13 of these key contract manufacturers in the area, such as the leading international companies Flex and Sanmina-SCI. Next in the chain, there are over 380 specialized suppliers, including 41 metal stamping and finishing companies, 25 plastics and thermoplastics manufacturers, 17 label and manual printers, and ten cable companies. This ecosystem is complemented by software and information technology companies, including 150 software development businesses, 16 outsourcing companies, and a few software parks and technology incubators.

These decades of investment in infrastructure, education, and development in Jalisco, and the resulting industrial and economic growth are proof of how clusters can facilitate the conditions for an upward spiral that enables industry to continually provide more value-added products. This added value attracts more research and development centers and companies looking to leverage this ecosystem, creating a more agile, robust, and articulate economy and supply chain.

If you are looking to start up operations in Mexico, reach out to our shelter services team to find out more about Jalisco’s industrial clusters and how you can take advantage of all the benefits they offer to increase your business’ competitiveness in today’s ever-changing international panorama.

By Marian Garibay | Guadalajara Regional Director | American Industries Group®

Subscribe

US toll-free: +1 (877) 698 3905

CAN toll-free: +1 (844) 422 4922

start@americanindustriesgroup.com

Please note that we do not accept job applications here. If you are interested in applying for a position, please visit the following link: https://www.americanindustriesgroup.com/jobs/

Related posts