Mexico Manufacturing: What You Need to Know About the IMMEX Program

By Jorge Baca | Queretaro Regional Director at American Industries Group®

Published 02/19/2025

In recent years, Mexico has become a key player in the global manufacturing industry. Much of this success is due to the implementation of strategic programs and initiatives that have enhanced the efficiency and competitiveness of its industries. One such initiative is the Manufacturing, Maquiladora and Export Services Industry Program, known as IMMEX.

This article provides an overview of IMMEX and its benefits, while also addressing some of the most frequently asked questions about the program.

What is the Manufacturing, Maquiladora and Export Services Industry Program (IMMEX)?

The IMMEX Program is a government initiative launched on November 1, 2006, aimed at attracting foreign investment and fostering economic growth in Mexico through industrial manufacturing and the export of goods and services.

Since its implementation, IMMEX has become one of the most advantageous programs for foreign and U.S. companies manufacturing in Mexico, attracting a large number of investors and becoming one of the country’s most successful economic development programs.

Its impact has been significant in many companies’ decisions to relocate manufacturing to Mexico. It has also contributed to the development of industrial and export infrastructure and helped consolidate supply chain ecosystems across various sectors.

Key Points about the IMMEX Program

- It is designed for companies engaged in manufacturing activities in Mexico

- It allows tax reductions through temporary deferral of import duties on foreign goods brought into the country

- Imported goods are used for manufacturing, transformation, or repair of products or services

- The resulting goods or services must be destined for export or export service provision

- The program offers incentives to qualified investors, including tax credits on import duties paid

- These credits apply to products that are subsequently exported, generating significant fiscal benefits

In summary, IMMEX enhances competitiveness and reduces operational costs for manufacturing companies operating in Mexico.

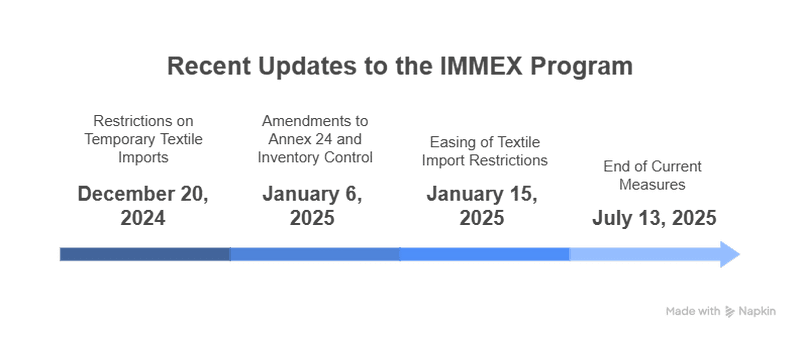

Recent Updates to the IMMEX Program

Since its inception, IMMEX has undergone several updates, with the most recent including:

Restrictions on Temporary Textile Imports

As of December 20, 2024, restrictions were imposed on the temporary importation of certain textile products under IMMEX. However, on January 15, 2025, the Ministry of Economy issued a directive easing these restrictions for companies that meet specific requirements, such as being registered under the Certification Scheme for VAT and Excise Tax (IVA and IEPS), authorizing online access to their automated inventory control system, and operating exclusively with tariff fractions imported in the last calendar year.

These measures will remain in effect until July 13, 2025, and may be revoked if a company is found non-compliant.

Amendments to Annex 24 and Inventory Control On January 6, 2025, changes were published to Annex 24 of the General Foreign Trade Rules, strengthening IMMEX companies’ obligation to allow remote access for tax authorities to their automated inventory control systems. Additionally, information must be updated within 48 hours following customs clearance. Companies must ensure their systems meet these requirements to avoid penalties.

Implementation of IMMEX 4.0 As part of the “Plan Mexico”, IMMEX 4.0 is being developed to modernize the program through automation and the use of artificial intelligence. This initiative aims to optimize manufacturing and export operations, reduce authorization times by 50%, and enhance sector oversight.

Practical Applications of the IMMEX Program

Auto Parts Manufacturing for Export. A company imports components and raw materials duty-free to assemble auto parts exported to the U.S. and Canada. IMMEX allows deferral of import duties on these inputs, reducing operating costs.

Electronic Equipment Production. A company manufacturing electronic devices imports circuit boards and parts for assembly, transforms them into finished products, and exports them. IMMEX permits temporary import of inputs without immediate tax payment.

Textile Industry. A textile company imports fabrics and accessories used to make garments for international markets, avoiding immediate tax payment on fabric imports under IMMEX, paying only when applicable upon sale.

Repair and Maintenance of Machinery for Export A company providing repair services for temporarily imported industrial machinery for maintenance or modification before re-export can import without paying duties immediately under IMMEX.

Food Processing and Packaging for Export. A company importing ingredients and packaging materials for food products destined for export benefits from IMMEX by deferring import taxes on these inputs.

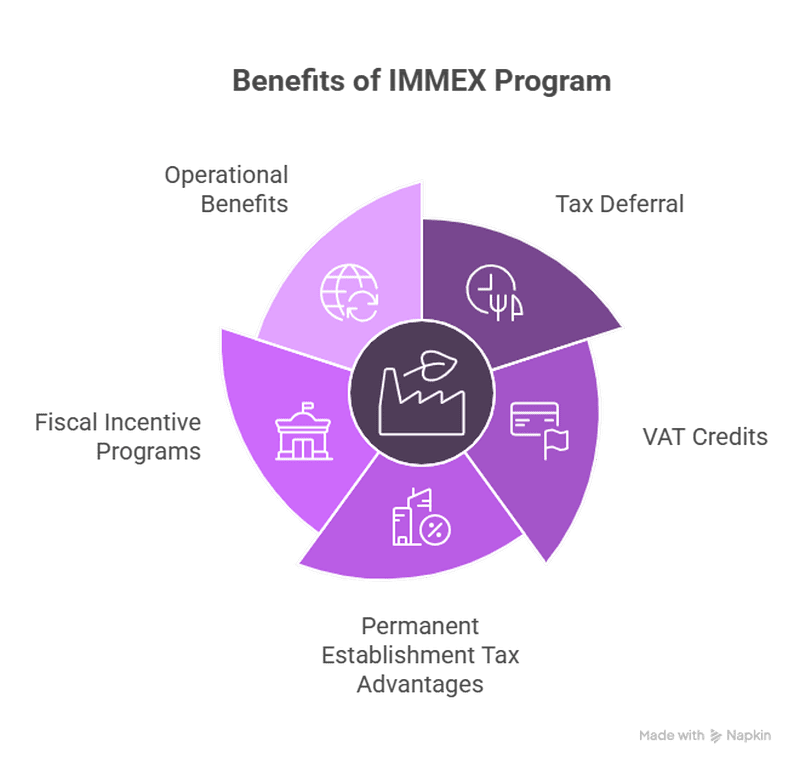

What Are the Benefits of IMMEX for Companies Manufacturing in Mexico?

Deferral and Exemption of Taxes on Temporary Imports

IMMEX allows non-resident companies to maintain imported goods and assets in Mexico for extended periods—ranging from 18 months to indefinitely while the program is active. This arrangement does not trigger permanent establishment tax consequences, reducing fiscal risks for foreign investors. If taxes are applicable, payment can be deferred, improving liquidity and cash flow. Additionally, the Sectorial Promotion Program (PROSEC) offers further exemptions on raw materials to reduce input costs.

VAT Tax Credits for Certified Companies

IMMEX companies with Exporting Certified Company (ECE) status may request VAT credits on temporary imports. VAT payment is deferred and only due when the import becomes permanent, optimizing financial management and reducing immediate tax costs.

Tax Advantages Related to Permanent Establishment

If all income comes from export activities, the company is not considered to have a permanent establishment in Mexico. Maquiladora services are subject to a 0% VAT rate, eliminating tax burdens along the production chain. Transactions between IMMEX companies may be subject to 0% VAT under specific conditions, facilitating internal trade among subsidiaries or certified suppliers. Purchases by non-resident companies from local providers may also benefit from 0% VAT in certain cases, supporting domestic procurement.

Access to Additional Fiscal Incentive Programs

IMMEX participants can access other government programs, such as VAT and Excise Tax (IVA and IEPS) certification. This additional certification increases flexibility and speeds customs, import, and export procedures. It provides additional fiscal savings and reduces operational costs for products subject to IEPS, such as alcoholic beverages, tobacco, or fuels.

Operational and Competitive Benefits

Facilitates integration into global supply chains via preferential fiscal treatment of imported inputs. Reduces administrative and tax burdens, allowing companies to focus on productivity and quality. Improves international competitiveness by lowering production costs and optimizing operational times.

Who Can Participate in the IMMEX Program?

IMMEX is available to all companies and entities interested in manufacturing activities, whether nearshore or offshore, in Mexico, aimed at exporting goods and services.

Eligible participants include:

- Legal Entities. Including a wide variety of business types such as industrial manufacturers, domestic factories, specialized service providers, and third parties involved in manufacturing and export processes.

- Manufacturing Companies. Businesses that manufacture, process, assemble, or repair temporarily imported goods for subsequent export.

- Service Providers. Companies offering services related to the manufacturing, transformation, or repair of products destined for export.

- Authorized Third Parties. Companies providing manufacturing or repair services on behalf of other exporters, including maquiladoras and subcontractors.

Inclusion of All Business Sizes

IMMEX is not limited to large corporations or multinationals. Small and medium-sized enterprises (SMEs) may also participate and benefit from the program, gaining access to fiscal incentives and facilitation to compete in international markets. This promotes productive inclusion and strengthens Mexico’s industrial supply chain, supporting economic diversification and job creation.

What Are the Requirements to Apply?

Non-resident companies must provide requested documentation proving legal operation in Mexico and current fiscal compliance, along with a detailed description of their processes or services, proof of legal possession of their operational facilities, and supporting documents.

This information must be submitted electronically through the Ministry of Economy’s website. A notary will then prepare an affidavit verifying the accuracy of the documentation and the location of operations.

Basic Participation Requirements

- Conduct manufacturing, transformation, or repair activities for goods intended for export

- Comply with Mexican tax and customs obligations for IMMEX companies

- Maintain controls and records to ensure traceability of goods imported and exported under the program

Companies must submit an electronic application via the Ministry of Economy’s website, accompanied by a notary’s affidavit verifying operation locations and supporting documentation.

The application must include a detailed description of company processes or services, capacity index and utilization percentage, HTS codes for finished products and raw materials, a commercial description of equipment used, production sector, and proof of legal possession of operational facilities with photographs. If facilities are leased, a lease agreement with at least one year remaining must be provided.

Additional required documents include:

- Proof the company is a legal entity subject to Title II of the Income Tax Law

- Registration in Mexico’s Federal Taxpayers Registry (RFC) and proof of legal representative

- Evidence that the company exports at least USD 500,000 annually or that exports represent at least 10% of total sales

- A maquila contract or purchase orders supporting company operations

- Compliance with inventory control regulations under Article 59, Section I of the Customs Law

After submission, the Ministry of Economy will review and notify the company within ten days of approval.

IMMEX companies must continue to fulfill obligations, including annual operational reports, timely tax payments, inventory control, and ensuring imported materials are used as authorized. Any operational or ownership changes must be reported to both the Ministry of Economy and tax authorities.

Eligible Products and Registration Categories

IMMEX covers three main categories of goods that may be imported under program benefits, provided they relate to manufacturing and export:

- Raw Materials and Production Inputs

Raw materials, parts, and components fully incorporated into exported goods. Fuels, lubricants, and consumables used during production. Packaging materials, labels, brochures, and graphics accompanying exported products for marketing - Containers and Transport Packaging

Containers, boxes, pallets, and other shipping systems used for packaging, storage, and secure transport of exported goods. These are essential to maintain product integrity during international logistics - Equipment, Machinery, and Tools for Production

Machinery, equipment, tools, instruments, molds, and spare parts used directly in producing or transforming export goods. Equipment for pollution control, industrial safety, research, training, and laboratories Telecommunications, IT, measurement, product testing, and quality control equipment. Material handling systems directly involved in production Administrative equipment supporting manufacturing operations under IMMEX

Companies must register under one or more categories depending on their operations or business model:

- Industrial. Direct registration for manufacturers importing goods for industrial processes producing export goods

- Services. Applies to services linked to exported goods with IMMEX registration, including legal entities, software developers, recyclers, and other service providers

- Holding Company. Applies to manufacturing operations of a certified holding company and one or more subsidiaries under the same program

- Outsourcing. Allows certified companies without manufacturing facilities to carry out production through a third party registered under their program

- Shelter. Designed for companies acting as fiscal or commercial shelters — intermediaries facilitating temporary import and export for other companies outsourcing production or logistics. The shelter allows multiple companies to use the infrastructure and IMMEX program of a single certified entity, optimizing costs, ensuring legal compliance, and simplifying customs and tax processes

Maximize the Benefits of the IMMEX Program

Would you like to fully leverage the benefits of the IMMEX program for your manufacturing operation in Mexico? At American Industries, we are your strategic partner in shelter services, with over 50 years of experience supporting foreign companies seeking to establish or expand their operations in Mexico.

Our expert team has deep knowledge of the IMMEX program, free trade agreements (FTAs), and all fiscal and administrative incentives to ensure your company operates with full legal compliance, efficiency, and security.

Whether your company belongs to the home appliances industry, medical devices, or another manufacturing sector, we offer comprehensive shelter solutions to facilitate your entry and growth in the Mexican market.

Contact us today at start@americanindustriesgroup.com and discover how we can drive the success of your operations in Mexico through our shelter program.

If you would like to find out more about this topic or are interested in receiving a complimentary business case analysis for your operation in Mexico, please fill out this form or contact us at:

US toll-free: +1 (877) 698 3905

CN Toll-free: +1 (400) 076 8899

Attention hours from M to F 9:00 - 18:00 CST

Please note that we do not accept job applications here. If you are interested in applying for a position, please visit the following link: https://www.americanindustriesgroup.com/jobs/