What car brands are manufactured in Mexico?

Published 02/12/2025

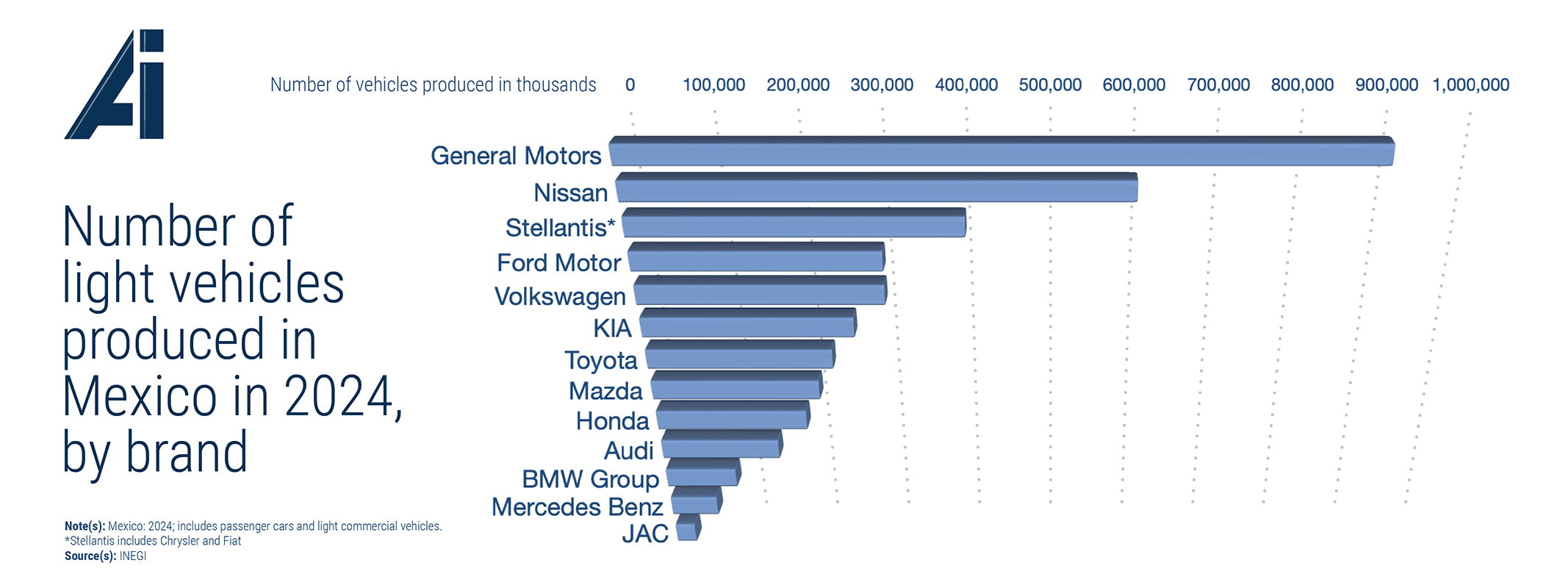

Mexico’s automotive industry has become a powerhouse in the global market, known for its robust automotive production in Mexico and its critical role in the North American supply chain. As a leader for American cars built in Mexico, the country produced over 2.3 million vehicles in the first seven months of 2024 alone, underscoring its significance in the global automotive landscape.

This article will explore the evolution of Mexico car factories, the contributions of major automakers like Ford and General Motors, and the impact of Mexican auto plants on exports, particularly to the USA.

The rise of the automotive industry in Mexico

The automotive manufacturing process in Mexico showcases a significant regional diversification, with major production hubs located in the Northern, Bajío, and Central zones. These regions are instrumental in sustaining Mexico's reputation as a leader in the auto industry, thanks to their advanced manufacturing facilities and access to supply routes and markets.

In the Bajío region, Guanajuato stands out with its robust automotive cluster, contributing significantly to Mexico's auto parts production with $1.41 billion in January 2024. This region is known for its dynamic approach to automotive manufacturing. Similarly, Querétaro plays an essential role in the Central zone, having produced auto parts worth $803 million, further emphasizing its strategic importance in the national automotive landscape. Both regions collectively demonstrate the vitality and growth potential of Mexico's auto parts industry.

Despite recent market fluctuations, the sector remains robust, supported by a workforce known for its skill, dedication, and, increasingly, innovation capabilities. The automotive labor market in Mexico continues to evolve, adapting to new technologies and processes that are crucial for meeting the changing demands of global markets.

This adaptability and resilience ensure that Mexico remains a competitive player in the global automotive manufacturing landscape, capable of bouncing back from setbacks and capitalizing on emerging opportunities within the industry.

What Cars Are Manufactured in Mexico?

Over the decades, automotive factories in Mexico have expanded and modernized, transforming the country from an assembly hub into a key player in global vehicle production. Thanks to its skilled workforce, cost-effective operations, and proximity to the U.S. market, Mexico has attracted major automakers that now manufacture a wide range of vehicles, from sedans and SUVs to electric models.

Automotive Manufacturing in Mexico

The country’s automotive plants are recognized for their high efficiency and advanced production capabilities, supplying vehicles to both domestic and international markets. Companies like Ford, General Motors, and BMW continue to invest in their Mexican facilities, reinforcing the country’s role in North America's automotive supply chain. Additionally, Mexico’s thriving auto parts sector supports this growth, with record-breaking production levels that further enhance the industry’s competitiveness.

GENERAL MOTORS

GM was one of the first international manufacturers to establish production operations in Mexico, allowing it to understand the market and leverage local talent. Today, it’s one of the country’s top vehicle exporters, demonstrating steady growth in its ability to supply the North American market and beyond.

Its plants are located in:

-

- Silao, Guanajuato. Producing pickups and SUVs such as the Chevrolet Silverado and GMC Sierra. This plant has been crucial in expanding GM’s export capacity to the U.S. and Canada under the USMCA, as it’s situated in a world-class industrial corridor.

- Ramos Arizpe, Coahuila. Manufacturing electric models and key components. In 2021, GM announced it would invest over USD 1 billion to convert Ramos Arizpe into an electric vehicle hub.

- San Luis Potosí. Assembly of compact models and engines.

Supplier Network & Local Impact

These cities have become major automotive hubs, attracting a vast network of Tier 1 and Tier 2 suppliers (stamping, plastic injection, harnesses, etc.), which in turn creates more jobs and diversifies the local economy.

NISSAN

Nissan has held the highest production volume in Mexico for many years and remains a dominant player in both the domestic and export markets. While there haven’t been massive new plant openings recently, there have been continuous investments to modernize and adapt production lines for new models and technologies.

Its plants are located in:

- Aguascalientes A1 and A2. Producing models like the Versa, Sentra and March, with exports to over 80 countries. The expansion of A2 was a key milestone, diversifying production to include premium and high-tech vehicles.

- Cuernavaca, Morelos. The CIVAC plant produces the NP300 and Frontier, as well as assembling other models. From 2026, it will focus on manufacturing pickups for Latin America.

Nissan A2 is one of the most automated plants in Latin America, allowing it to increase production by over 50% since it opened in 2013.

FORD

Ford has a significant presence in Mexico, with four manufacturing plants that are key to its global operations. The company has made substantial investments to modernize and adapt its facilities, focusing on electric mobility.

Its plants are located in:

- Cuautitlán Izcalli, State of Mexico. This plant produces the Mustang Mach-E, one of the brand’s flagship electric models. Recently, it has been pivotal in boosting electric vehicle production, marking a milestone in Ford’s global electrification strategy.

- Hermosillo, Sonora. This plant assembles vehicles like the Ford Bronco Sport and Ford Maverick. Its proximity to the U.S. border enables rapid exports.

- Chihuahua. This plant manufactures engines and critical components for the automotive industry, including internal combustion engines for Ford’s global lineup.

- Irapuato, Guanajuato. This specialized plant has produced more than six million transmissions since it opened in 2017.

Ford’s most notable growth in recent years has been its strategic shift toward electrification. The investment of more than USD 1.1 billion in the Cuautitlán Izcalli plant to produce the Mustang Mach-E was a key milestone.

AUDI

Audi’s growth in Mexico centered on the opening of its high-tech plant in 2016—a strategic move to bring production closer to the North American market and capitalize on trade agreements.

Located in San José Chiapa, Puebla, it was Audi’s first plant in North America and one of the brand’s most technologically advanced facilities worldwide. It produces the Audi Q5 (including the Q5 TFSIe plug-in hybrid version) and is known for advanced automation and robotics, sustainability efforts, waste reduction, and efficient resource use.

FIAT

Now part of Stellantis after the FCA-PSA merger, Fiat’s operations in Mexico have benefited from synergies and the global strategy of the new megacorporation.

Its plants are located in:

-

- Saltillo, Coahuila. The Saltillo Automotive Complex is one of Stellantis’ largest and most diverse sites worldwide. It mainly produces RAM trucks (RAM 1500 Classic, RAM 2500/3500/4500/5500 Heavy Duty), the RAM Promaster (commercial van), and the Fiat Ducato Van (for select markets). It also manufactures engines and performs casting and stamping operations for key components.

- Toluca, State of Mexico. The Toluca Automotive Complex focuses on producing the Jeep Compass. It previously built models such as the Fiat 500 and the Dodge Journey (sold as the Fiat Freemont in some markets).

Strategic Automotive Cities

Both cities are industrial pillars in their respective states. Saltillo is the heart of Coahuila’s automotive cluster, supported by a vast network of suppliers linked to Stellantis’ operations, while Toluca is a historic manufacturing hub.

BMW

San Luis Potosí is home to BMW’s plant in Mexico since 2019, one of the most modern and sustainable worldwide. It currently produces the BMW 3 Series Sedan (including a plug-in hybrid version for some markets), the BMW 2 Series Coupé, and the BMW M2. It’s a key center for these models, especially the 2 Series Coupé, which is exclusively built in Mexico.

VOLKSWAGEN

Volkswagen has had steady growth and an iconic presence in Mexico since the last century. Its recent growth has focused on modernizing production capacity and adapting to market trends (SUVs), with continuous investments to introduce new models and upgrade assembly lines.

Its plants are located in:

- Puebla, Puebla. The Cuautlancingo complex is the largest VW plant outside Germany and has a rich history in Mexico. It currently produces the Volkswagen Jetta, Volkswagen Taos, and Volkswagen Tiguan—serving as a key center for sedan and SUV production for North America. It also has a stamping plant and an engine plant to support its assembly lines.

- Silao, Guanajuato. Home to the EA211 engine plant (including the 1.5 TSI), these next-generation combustion engines are exported to other VW facilities in North America.

Volkswagen is a major player in both vehicle exports and the domestic Mexican market.

MAZDA

Since its arrival in Mexico in 2014, Mazda has become a major economic force. Located in Salamanca, Guanajuato, Mazda de México Vehicle Operation (MMVO) is a key production hub for the Americas and other regions.

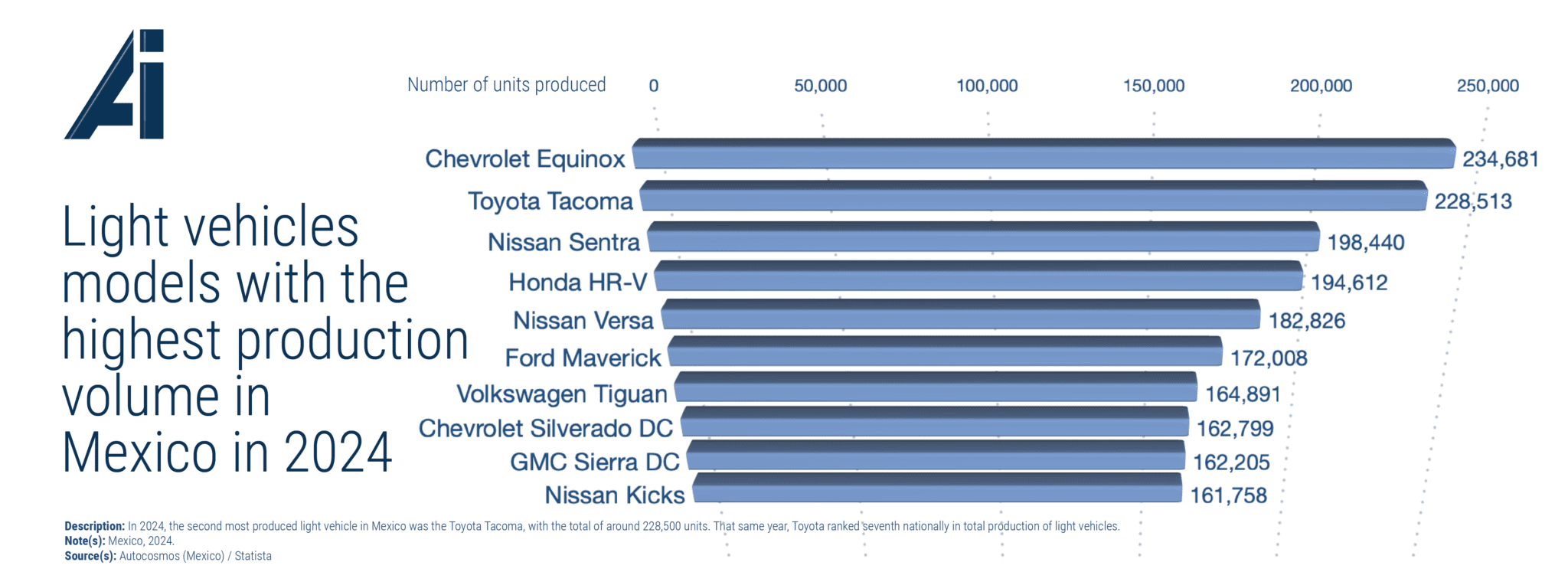

It builds the Mazda 2, Mazda 3 Sedan, Mazda CX-3, and Mazda CX-30 and has also produced vehicles for Toyota (previously the Yaris R Sedan), showcasing its flexibility and efficiency. In recent years, it has become Mazda’s main production hub for the Americas, reflecting its strategic importance for the brand globally.

Mazda’s arrival reinforced the Bajío region’s status as Mexico’s premier automotive corridor, attracting a network of suppliers and creating a vibrant industrial ecosystem in Salamanca and beyond.

HONDA

Honda’s significant growth in Mexico came with an USD 800 million investment in the Celaya plant, inaugurated in 2014, which dramatically boosted its car production capacity in the country.

Today, its plants are located in:

- Celaya, Guanajuato. Producing the Honda HR-V SUV. Previously, it also built the Honda Fit. This modern and efficient facility supplies the regional market.

- El Salto, Jalisco. This plant produces motorcycles and small engine power products. Historically, it also produced vehicles like the CR-V.

Honda’s focus on HR-V production in Celaya reflects its strategy to meet the strong demand for SUVs—a key segment in the market.

While the El Salto plant has specialized in motorcycles, the investment in Celaya has significantly expanded Honda’s automotive manufacturing footprint in Mexico.

KIA

KIA’s growth in Mexico has been one of the most impressive in recent years. Its plant is located in Pesquería, Nuevo León, where it produces the Forte, Rio and other export models. With an initial investment of over USD 3 billion, the Pesquería plant was inaugurated in 2016 and quickly became a major player.

Strategic Automotive Cities

Both cities are industrial pillars in their respective states. Saltillo is the heart of Coahuila’s automotive cluster, supported by a vast network of suppliers linked to Stellantis’ operations, while Toluca is a historic manufacturing hub.

TOYOTA

Since arriving in Mexico in 2004, Japanese automaker Toyota has grown significantly through its plants in:

- Tecate, Baja California. Toyota’s first plant in Mexico, inaugurated in 2004. It has primarily produced the Toyota Tacoma pickup. Toyota has invested over USD 1.4 billion in its Mexican operations over the past 20 years, with the Tecate plant representing an initial investment of around USD 180 million.

- Apaseo el Grande, Guanajuato. Toyota’s newest plant in Mexico, officially inaugurated in February 2020, also focused on producing the Tacoma pickup for the North American market.

What is the most popular car brand in Mexico?

In Mexico, the most popular car brand is Nissan. For more than a decade, Nissan has led sales thanks to models like the Versa, March, and Sentra—vehicles that meet the Mexican market’s demands for price, fuel efficiency, and durability.

Other favorites include Chevrolet and Volkswagen, driven by strong dealer networks and consumer trust in their quality.

This popularity highlights the growing demand for reliable, affordable vehicles that address mobility needs in Mexico’s major cities.

What percentage of American cars are made in Mexico?

🔎 Roughly 30–40% of light vehicles built for the U.S. market come from Mexican plants. This share can vary slightly from year to year depending on demand, nearshoring strategies, and trade agreements between the two countries.

Are cars made in Mexico reliable?

Absolutely. Cars built in Mexico have an excellent global reputation. Many automotive plants in Mexico—Volkswagen, Ford, GM, BMW, Audi, KIA—operate to the highest global quality standards.

Mexico has invested for decades in workforce training and industrial infrastructure, ensuring that production processes are efficient, safe, and reliable.

The reliability of Mexican-made cars is further proven by their strong export performance to demanding markets like the U.S., Canada, Europe, and Asia, where they must meet strict safety and quality standards.

For automotive sector decision-makers considering expansion, relocation, or establishing new partnerships in Mexico, American Industries is the ideal partner to navigate the landscape. Check one of our client’s testimonials here! We invite you to contact us for a free business case analysis to get an idea of what an expansion into Mexico entails. Reach out today to explore the opportunities that await in Mexico’s thriving automotive industry.

American Industries Group®

If you would like to find out more about this topic or are interested in receiving a complimentary business case analysis for your operation in Mexico, please fill out this form or contact us at:

US toll-free: +1 (877) 698 3905

Attention hours from M to F 9:00 - 18:00 CST

Please note that we do not accept job applications here. If you are interested in applying for a position, please visit the following link: https://www.americanindustriesgroup.com/jobs/

YOU MIGHT ALSO LIKE