Strategic Shift: From Offshoring to Nearshoring for Improved Agility and Cost Savings

Published 02/21/2024

The nearshoring phenomenon is reshaping the industrial map of North America, with Mexico at the heart of this transformation. Between January and September 2024, the country attracted $35.7 billion USD in Foreign Direct Investment (FDI), approaching a projected record high of $38.4 billion USD by year-end.

This trend is largely driven by american companies moving to Mexico, which represent 45% of the invested capital, followed by Japan, Germany, and Canada.

The manufacturing sector is the main protagonist, concentrating 54% of the FDI, with key industries such as transportation, electronics, beverages, tobacco, chemicals, and basic metal products. Moreover, experts estimate that nearshoring could add up to 3% to Mexico’s GDP over the next five years, highlighting its potential as a development engine.

In this context, exploring the benefits of this strategy is essential to understand why Mexico has become the preferred destination for relocating operations.

Today, we analyze the benefits of nearshoring, how it differs from offshoring, and why more and more american companies that moved to Mexico are boosting their growth and gaining greater advantages.

What Is Nearshoring?

Nearshoring is a business strategy that involves moving production processes, operations, or services to countries close to the target market, instead of placing them in distant locations such as Asia. Unlike offshoring, which prioritizes low costs regardless of distance, nearshoring seeks a balance between savings, logistical efficiency, and greater operational control.

This model has gained global relevance due to several factors: supply chain disruptions after the pandemic, rising maritime shipping costs, the U.S.-China trade war, and the need for greater operational resilience.

By locating production centers closer to the end consumer, companies can reduce delivery times, lower geopolitical risks, and optimize logistics costs.

Mexico as a Strategic Nearshoring Destination: Why Are So Many Companies Moving to Mexico?

Mexico has solidified itself as one of the most attractive nearshoring destinations worldwide, especially for american companies moving to Mexico that seek efficiency without sacrificing proximity. Multiple reasons underlie this trend:

- Privileged Geographic Location: Sharing a long border with the United States enables significantly shorter transportation times compared to Asia, facilitating more agile supply chains

- Strong Trade Agreements: With USMCA (T-MEC), Mexico enjoys preferential access to one of the world’s largest markets, providing a competitive edge for companies establishing operations in the country

- Consolidated Industrial Capacity: The country has a mature manufacturing base, modern logistics infrastructure, and a skilled workforce, particularly in sectors like automotive, aerospace, electronics, and medical devices

- Macroeconomic Stability and Growth Opportunities: Projections indicate that nearshoring could increase Mexico’s GDP by up to 3% in five years, creating a favorable economic context.

Mexico’s Economic Drive Behind Nearshoring 🚛

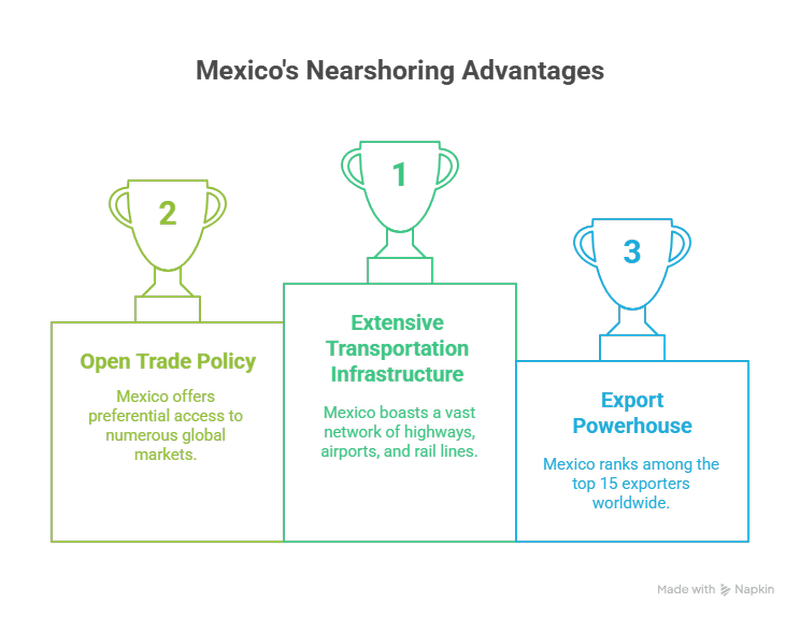

Beyond its strategic location, Mexico has become a strategic partner for american companies moving to Mexico due to the following factors:

• Open Trade Policy. Preferential access to nearly 50 markets through 13 free trade agreements, 9 economic complementation agreements, and 32 bilateral investment promotion and protection treaties

• Export Powerhouse Mexico ranks among the top 15 exporters globally, with annual exports totaling $387 billion USD

• Stable Foreign Direct Investment Consistent FDI between $30 billion and $35 billion USD over the past six years, with over 47% channeled toward manufacturing industries and Industry 4.0

What Companies Are Moving to Mexico?

In 2025, Mexico has established itself as a strategic nearshoring destination, attracting numerous american companies moving to Mexico that aim to optimize their supply chains and reduce operational costs. Some of the top U.S. companies with offices in Mexico and the booming sectors include:

| Company | Focus |

|---|---|

| Whirlpool | Has relocated part of its production to Mexico to leverage proximity to the U.S. market and reduce delivery times |

| Honeywell | Expanded operations focused on manufacturing electronic components and automation systems |

| General Motors | Increased investment in Mexican plants for vehicle and automotive parts production |

| Foxconn & Flex | Technology giants expanding their manufacturing centers for electronics and tech products |

| Continental | Strengthened operations producing automotive industry components |

| Walmart | Announced an investment exceeding $6 billion USD in Mexico, including advanced distribution centers and approximately 5,500 direct jobs created |

Thriving Sectors in Mexico

Mexico positions itself as a key player in the global economy through various sectors experiencing significant growth. This not only attracts foreign investment but also generates employment and fosters innovation:

- Automotive: Driven by investments from companies like General Motors and Continental, remaining a pillar of Mexico’s economy

- Electronics and Technology: With Foxconn and Flex expanding, Mexico has become a central hub for electronic and technological manufacturing

- Medical Devices: Global demand fuels growth in medical equipment production

- Textile and Apparel: Benefiting from proximity to the U.S. market and favorable trade agreements

- Logistics and Distribution: Investments in modern distribution centers highlight the sector’s growth

Key Industrial Clusters in Mexico:

- Bajío/Guanajuato: Automotive

- Querétaro: Automotive

- Ciudad Juárez: Electronics

- Jalisco (Guadalajara): IT and high technology, especially Guadalajara

- Chihuahua: Aerospace

These technological capabilities combined with other advantages position Mexico as a privileged destination for factories moving to Mexico.

Business Models for Manufacturing in Mexico

Companies moving production to Mexico have several options for establishing manufacturing operations:

- Setting up an independent operation

- Forming a joint venture

- Acquiring an existing company

- Contract manufacturing

- Partnering with a shelter service provider like American Industries

For most manufacturers, especially those without prior experience in Mexico seeking to start operations quickly (in as little as nine weeks), the shelter program is the most advantageous option. This comprehensive package allows companies to focus on their core manufacturing and distribution business while the shelter provider manages daily administrative and legal matters.

From Offshoring to Nearshoring

The shift from offshoring to nearshoring is a significant strategic evolution for manufacturing companies. While offshoring offered lower production costs, it entailed challenges such as extended supply chains, quality control issues, and cultural/language barriers.

The trend toward nearshoring in Mexico addresses the need for:

- Greater agility to respond quickly to market changes and consumer demands

- Business continuity, especially relevant post-pandemic

- Shorter delivery times by relocating operations closer to key markets

- Better control over manufacturing processes and collaboration with local suppliers

Nearshoring represents a key opportunity for companies looking to optimize operations and respond more agilely to a dynamic, competitive global environment. By moving production processes to nearby countries like Mexico, companies can leverage several benefits directly impacting efficiency and profitability:

- Reduced Delivery Times: Geographic proximity between the U.S. and Mexico shortens the supply chain, enabling faster deliveries and better responsiveness to market demand changes

- Optimized Operating Costs: While labor cost may not always be the lowest, savings from reduced transportation, tariffs, and storage costs generate comprehensive cost reductions

- Greater Control and Oversight: Being closer to production plants enables improved quality controls, facilitates communication, and allows rapid reaction to contingencies or process adjustments

- Mitigation of Geopolitical and Logistical Risks: Volatility in international trade routes, affected by trade tensions or port issues, is minimized in a stable and nearby geographic environment

- Access to Specialized Talent: Mexico offers a skilled workforce in strategic industries, facilitating the integration of advanced technology and innovative processes

- Sustainability and Social Responsibility: Reduced transportation distances lower the supply chain’s carbon footprint, supporting environmental goals and enhancing corporate image

- Mature Supply Chains and Infraestructure: Mexico has an established network of suppliers across multiple industries, advanced logistics and transportation systems, and strong support for high-tech manufacturing that facilitates integration and scalability

- Robust Infrastructure and Favorable Trade Agreements: State-of-the-art manufacturing facilities and technology parks, along with benefits from agreements like USMCA, reduce tariffs and expedite trade processes, fostering an efficient and competitive environment

Attractive for Offshore Manufacturers Mexico offers a stable and favorable business environment that combines cost efficiency with high-quality standards, balancing operating expenses with the strategic benefits of proximity to the North American market.

These elements collectively position Mexico as a privileged destination for offshore companies seeking to capitalize on nearshoring advantages. The transition to nearshoring in Mexico aligns with the need for operational agility and market responsiveness, providing a strategic edge in the global competitive landscape.

Enhancing Manufacturing Processes with Advanced Technologies in Mexico

Beyond logistical and cost advantages, Mexico stands out for its technological advances. Its robust industrial infrastructure and access to cutting-edge technologies make it an ideal place to optimize manufacturing processes.

Established industrial clusters in key sectors like automotive, electronics, and aerospace foster collaboration and innovation, creating an environment where companies thrive, share best practices, and drive technological progress. This positions Mexico as a center of advanced manufacturing, attracting companies aiming to remain competitive globally.

Maximize Nearshoring Benefits with American Industries’ Shelter Program

Partnering with American Industries through its shelter administrative services program is the easiest path to transition your production to Mexico.

Five key benefits of a shelter partnership include:

- Operational Sovereignty: You retain full control over your operations, ensuring productivity, quality, customer satisfaction, and timely delivery are never compromised

- Cost and Time Efficiency: Gain immediate operational capacity with an established Mexican legal entity, complete with certifications, software, hardware, and licenses. This reduces initial costs compared to independent operations and enables a rapid launch

- Tax Advantages: Benefit financially from not paying VAT on raw materials, equipment imports, and local purchases, amplifying savings through economies of scale from day one

- Expert Guidance: Continuous consulting services ensure your venture avoids unexpected costs or price increases

- Risk Mitigation: Operate with full compliance to Mexican laws and regulations, significantly reducing potential risks and liabilities

This strategic collaboration with American Industries allows companies to focus on their core competencies while minimizing risks and maximizing efficiency.

The future of nearshoring in Mexico

Embracing nearshoring to Mexico offers many cost-saving opportunities, from labor to logistics, which are amplified by partnering with experienced shelter service providers. Companies benefit from competitive labor rates for skilled positions, reducing expenses and optimizing operations.

The nearshoring transition represents a strategic investment in operational agility, profitability, and geographic proximity, enhancing business resilience and regional economic integration.

As Mexico continues investing in technology, workforce, and infrastructure, its position as a leading nearshoring hub is on the rise, promising a solid foundation for companies aiming to succeed in the global market.

If you are considering the strategic advantages of nearshoring or reshoring in Mexico, contact American Industries. Let us guide you to unlock the full potential of your business. Contact American Industries today to start your journey.

If you would like to find out more about this topic or are interested in receiving a complimentary business case analysis for your operation in Mexico, please fill out this form or contact us at:

US toll-free: +1 (877) 698 3905

Attention hours from M to F 9:00 - 18:00 CST

Please note that we do not accept job applications here. If you are interested in applying for a position, please visit the following link: https://www.americanindustriesgroup.com/jobs/

YOU MIGHT ALSO LIKE