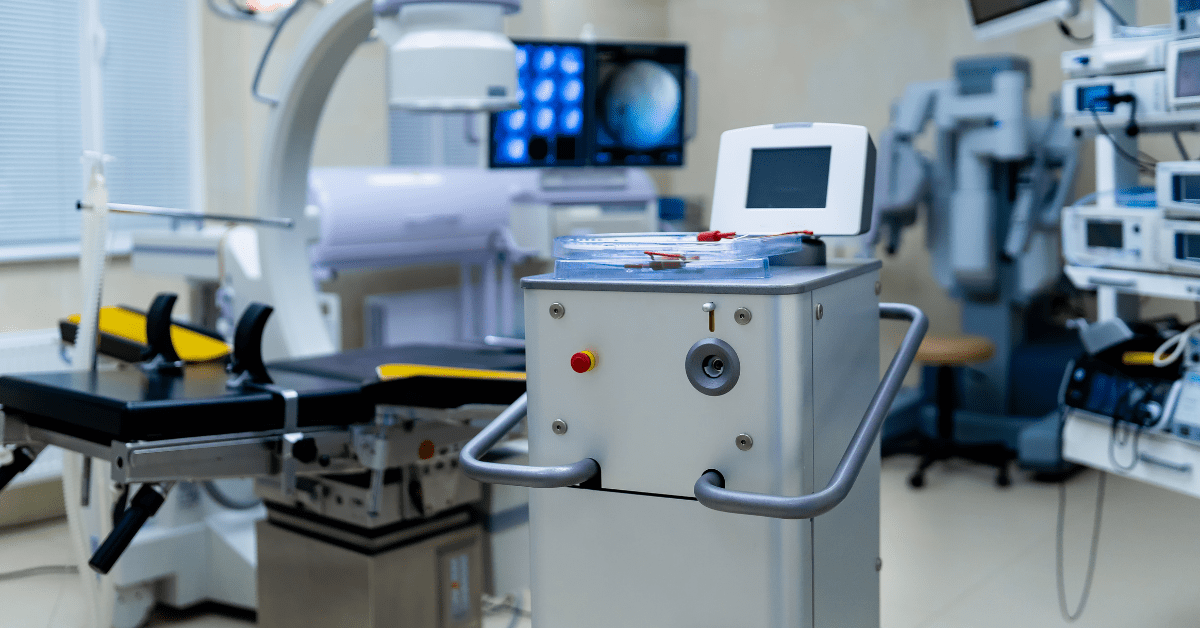

Mexico has become one of the most important markets for medical equipment and devices in the Americas. Currently, medical equipment and components are imported to Mexico from the United States or Canada duty free, processed and assembled for re-export. The growing demand for healthcare services and the availability of skilled labor have made Mexico extremely attractive to importers, exporters and investors.

Mexico, a reliable partner for medical device manufacturing

Its privileged location and ability to develop a wide range of products, from diagnostic devices to medical consumables, positions Mexico as a versatile and innovative leader in the sector.

Facts and figures about the medical industry in Mexico

-

World leaders in exports to the U.S.

-

More than US$3.4 billion exported to the U.S. in 2012.

-

223 companies manufacturing medical devices

-

92% of medical devices manufactured are exported to the U.S.

Medical industry in Mexico, innovation and efficiency in the manufacture of medical devices

Advantages of manufacturing medical and surgical devices in Mexico.

-

Proximity to the United States. Thanks to its proximity to the United States, Mexico offers efficient logistics, integration into the U.S. medical ecosystem and regulatory alignment.

-

Quality and compliance. Mexico complies with the highest international standards, producing class I, II and III devices endorsed by the FDA. With certifications such as FDA, CE and ISO 13485, its manufacturers guarantee quality and regulatory compliance, positioning themselves as reliable partners for global medical companies.

-

Cost-effective manufacturing. With competitive labor costs and efficient production processes, Mexico offers a cost-effective alternative to China, while maintaining high quality standards in labor and products.

-

Efficiency and talent in medical manufacturing. A competitive economic environment, skilled labor and an advanced supply chain make Mexico an ideal and profitable option for global investors in medical manufacturing.

Mexico's impact on medical device manufacturing.

With projections pointing to a $20 billion global medical device market by 2028, Mexico is positioned as a strategic hub in this growth.

Leading companies such as Medtronic, Johnson & Johnson and Siemens rely on the country's manufacturing capabilities, highlighting its quality and competitiveness. In addition, Mexico's skilled labor force, developed under a collaborative model between government, industry and academia, guarantees high standards and solid leadership in international medical trade, especially with the United States.

How to take advantage of the opportunities offered by medical manufacturing in Mexico?

To enter the medical device manufacturing sector in Mexico, it is key to adopt a strategic approach that maximizes your potential. Specialized services, such as those provided by American Industries, offer you comprehensive support in key areas such as legal guidance, regulatory compliance and operational assistance. This support model not only simplifies your market entry process, but also minimizes risk and allows you to focus on your core objectives while taking full advantage of Mexico's competitive advantages.

Want to know how to manufacture medical devices in Mexico?

Find out how to take advantage of these opportunities with the support of American Industries. Request a free business case analysis and learn about the benefits and investment possibilities in this dynamic market.